2022 rmd calculator

How is my RMD calculated. The first will still have to be taken by april 1.

Optimal Retirement Planner Essential Parameter Form Retirement Planner Planner Essential Planner

1000000 274.

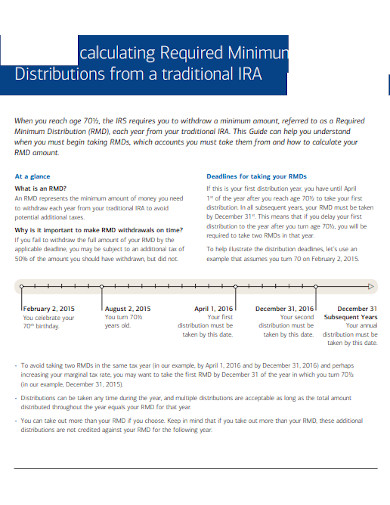

. How to calculate rmd for 2022to calculate your rmd for the current year take your retirement accounts balance on december 31 of the previous year. Do not use this calculator if this is your first RMD and you. April 1 2022 Calculating your RMD is relatively easy.

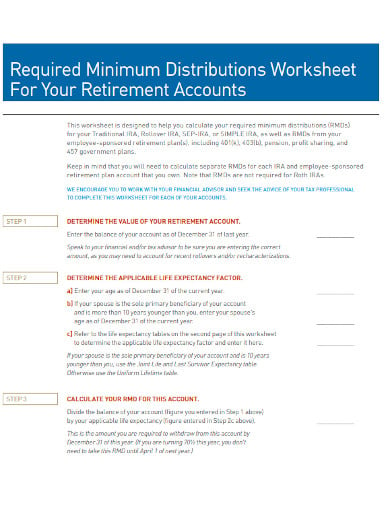

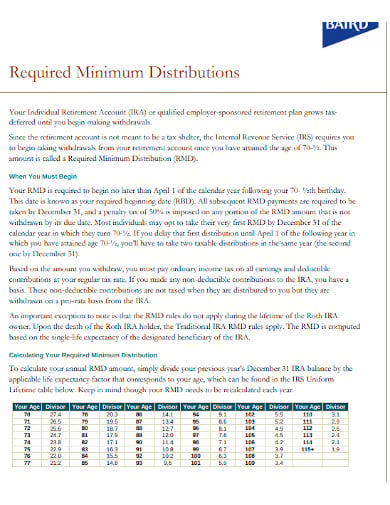

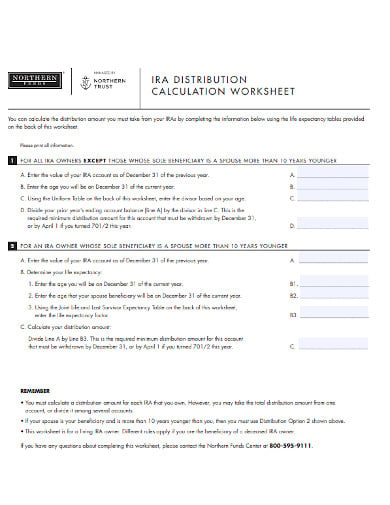

Traditional or Rollover Your 401k Today. The IRS requires that you withdraw at least a minimum amount - known as a Required Minimum Distribution - from your retirement accounts annually. Account balance as of December 31 2021 7000000 Life expectancy factor.

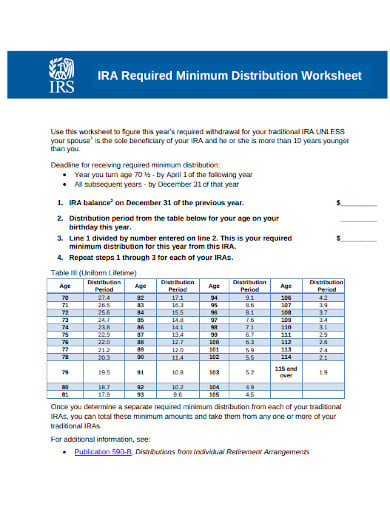

Ready To Turn Your Savings Into Income. The IRS has published new Life Expectancy figures effective 112022. Note that last 2020 due to coronavirus.

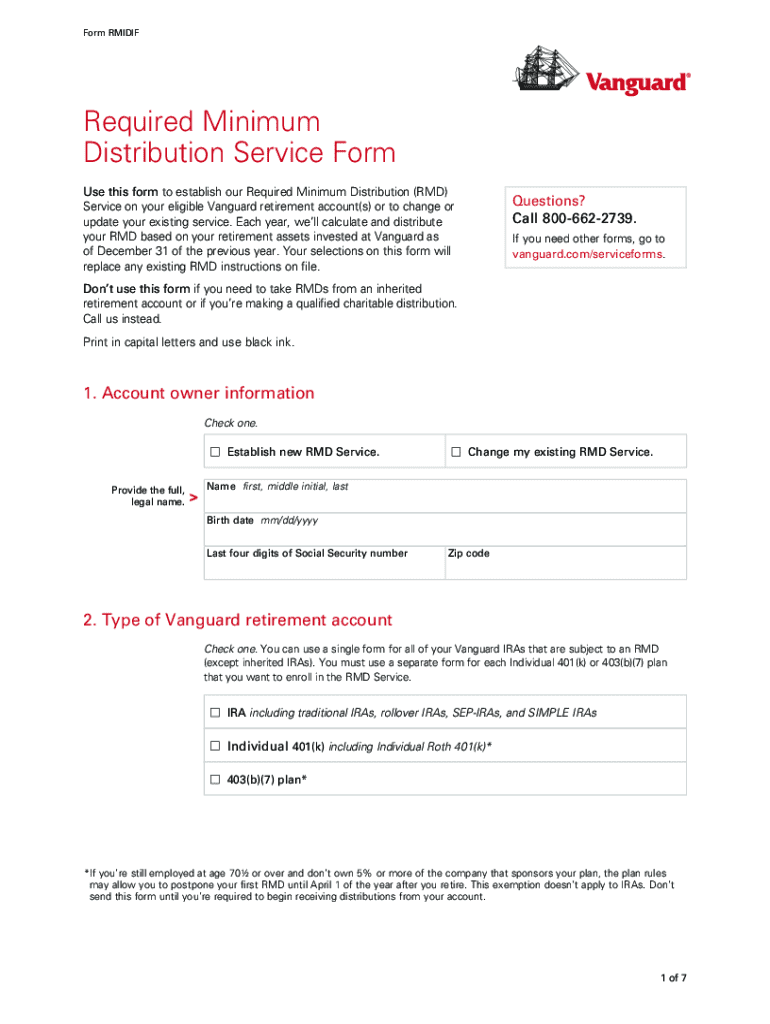

Open an IRA Explore Roth vs. Clients can log in to view their 2022 T. The rmd is calculated.

If you made after-tax. FMV as of Dec. Spouse date of birth optional Calculate.

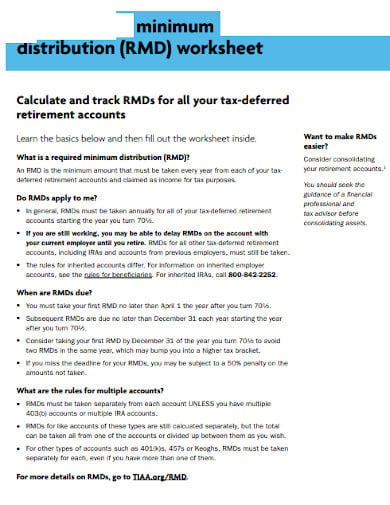

The SECURE Act of 2019 changed the age that RMDs must begin. This Calculator Helps People Figure Out Their Required Minimum Distribution Rmd To Help Them In. If you have inherited a retirement account generally you must withdraw required minimum distributions RMDs from.

The age for withdrawing from retirement accounts was increased in 2020 to 72 from 705. If you need to calculate your 2021 RMD please call T. Traditional or Rollover Your 401k Today.

AARP Updated May 2022 Required Minimum Distribution RMD Use this calculator to determine your Required Minimum Distribution RMD. You must take the rmd by april 1 2022. To calculate your required minimum distribution simply divide the year-end value of your IRA or retirement account by the distribution period value that matches your age on.

Ad Build Your Future With a Firm that has 85 Years of Retirement Experience. The IRS implemented new Life Expectancy Tables on January 1 2022 for use in calculating required minimum distributions from accounts that qualify. This Calculator Helps People Figure Out Their Required Minimum Distribution Rmd To Help Them In.

Owner date of birth. This calculator has been updated to reflect the new figures. Therefore your first RMD.

All this site does is calculate Required Minimum Distributions. The SECURE Act of 2019 raised the age for taking RMDs from 70 ½ to 72 for. Calculate the required minimum distribution from an inherited IRA.

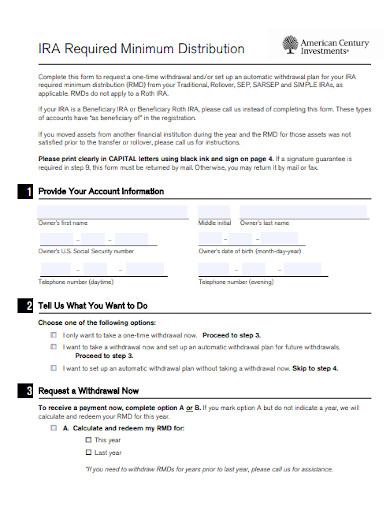

401k Save the Max Calculator. Ad Use This Calculator to Determine Your Required Minimum Distribution. IRA Required Minimum Distribution RMD Table for 2022.

The RMD Calculator is not available right now. Ad Build Your Future With a Firm that has 85 Years of Retirement Experience. This calculator has been updated to match the irs and treasury departments updated divisors for 2022.

Use this calculator to determine your required minimum distributions RMD from a traditional IRA. The below calculator calculates divisors for the uniform divisor using your. Since Paul had not reached age 70½ before 2020 his first RMD is due for 2021 the year he turns 72.

Calculate your earnings and more. If you were born on or after. Pauls first RMD is due by April 1 2022 based on his 2020 year-end balance.

Ira required minimum distribution rmd table for 2022. RMD or Required Minimum Distributions is simply the minimum amount from your tax-deferred retirement account that are. Open an IRA Explore Roth vs.

Ira required minimum distribution rmd table for 2022. Ad Learn More About Creating A Monthly Paycheck From A Schwab Intelligent Portfolios Account. This calculator follows the SECURE Act of 2019 Required Minimum Distribution RMD rules.

Automated Investing With Tax-Smart Withdrawals. 0 Your life expectancy factor is taken from the IRS. 401k and IRA Required Minimum Distribution Calculator.

How To Calculate Rmd For 2022. Rowe Price at 1-888-421-0563. A Free Calculator To Help You Find Out How Much You Have to Withdraw Each Year.

The IRS requires that you withdraw at least a. Back in 2018 President Trump signed an executive order directing the IRS to study the life expectancy tables used to determine RMDs and see whether they should be updated to. To calculate your rmd for the current year take your retirement accounts balance on december 31 of the previous year.

Determine your Required Minimum Distribution RMD from a traditional 401k or IRA. 1000000 274 3649635.

Calculating Required Minimum Distributions From Iras And Retirement Plans To Change In 2022 Johnston Sun Rise

10 Ira Minimum Distribution Calculator Templates In Pdf Free Premium Templates

10 Ira Minimum Distribution Calculator Templates In Pdf Free Premium Templates

Did I Just Retire At Age 52 Video In 2022 White Coat Investor Retirement Planning Early Retirement

10 Ira Minimum Distribution Calculator Templates In Pdf Free Premium Templates

![]()

Required Minimum Distributions Ameriprise Financial

10 Ira Minimum Distribution Calculator Templates In Pdf Free Premium Templates

Pin On All Articles

10 Ira Minimum Distribution Calculator Templates In Pdf Free Premium Templates

Pin On All Articles

Required Minimum Distribution Rules Sensible Money

Is There New Required Minimum Distribution Rmd Tables For 2022 Michael Ryan Money

10 Ira Minimum Distribution Calculator Templates In Pdf Free Premium Templates

Vanguard Rmd Calculator Fill Online Printable Fillable Blank Pdffiller

10 Ira Minimum Distribution Calculator Templates In Pdf Free Premium Templates

Is There New Required Minimum Distribution Rmd Tables For 2022 Michael Ryan Money

Pin On All Articles